Evaluating Automated Valves: A Comparative Analysis of Performance Metrics and Efficiency in Industrial Applications

In recent years, the industrial sector has witnessed a significant shift towards automation, with automated valves emerging as a pivotal component in optimizing operational efficiency and performance. According to a report by MarketsandMarkets, the global automated valve market is expected to reach USD 5.9 billion by 2025, reflecting a compound annual growth rate (CAGR) of 6.1% from 2020. This growth underscores the increasing reliance on automated valves to enhance process control, ensure safety, and reduce operational costs across various industries, including oil and gas, water and wastewater treatment, and chemical manufacturing.

As industries strive for greater efficiency and reliability, evaluating the performance metrics of automated valves becomes crucial. This blog will explore the comparative analysis of automated valves, focusing on their efficiency and effectiveness in industrial applications, supported by key performance indicators and industry standards.

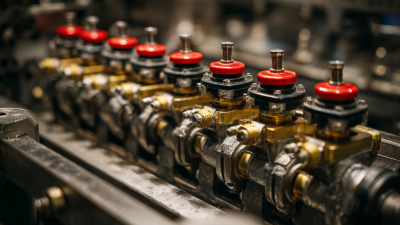

Comparative Overview of Automated Valve Types and Their Applications in Industry

Automated valves play a crucial role in various industrial applications, offering different types tailored to specific needs. The market for electromagnetic valves is significant, and projections indicate that it will continue to grow through 2032, driven by the increasing demand in sectors ranging from manufacturing to energy. Electromagnetic valves are known for their rapid response times and reliability, making them ideal for processes that require precise flow control.

Additionally, electrohydraulic servo valves (EHSV) are gaining traction, with a forecasted market growth from 2022 to 2030. These valves are critical in applications dealing with high forces and precise movements, often found in mining, aerospace, and heavy machinery. The ability to seamlessly integrate these valves into automated systems enhances operational efficiency and reduces downtime.

The broader valve and fittings market is also expanding, expected to reach substantial revenue growth in the coming years. As industries increasingly adopt automation and smart technologies, understanding the comparative performance and efficiency of different automated valve types becomes essential. Each type of valve offers unique advantages depending on the application, further emphasizing the importance of selecting the right valve to optimize productivity and operational efficiency in industrial settings.

Key Performance Metrics: Evaluating the Efficiency of Automated Valves

When evaluating the efficiency of automated valves in industrial applications, several key performance metrics come into play. One of the primary metrics is response time, which measures how quickly a valve can open or close in reaction to control signals. A shorter response time is crucial for processes requiring precise control and rapid adjustments to maintain operational integrity. Additionally, the durability and reliability of the valve are significant, particularly in harsh industrial environments. These factors directly influence downtime and maintenance costs, making them essential for evaluating overall efficiency.

Another important metric is flow coefficient (Cv), which quantifies the valve's ability to control flow rates. A higher Cv value indicates a more efficient valve that can handle larger volumes with less energy consumption. Pressure drop across the valve also plays a critical role; minimizing pressure loss leads to more efficient system operation, reducing energy costs and enhancing system longevity. Furthermore, the integration of smart technology into automated valves allows for real-time monitoring and data analytics, offering insights into performance and facilitating proactive maintenance. Together, these metrics provide a comprehensive framework for assessing the efficiency of automated valves in various industrial applications.

Evaluating Automated Valves: A Comparative Analysis of Performance Metrics and Efficiency in Industrial Applications - Key Performance Metrics: Evaluating the Efficiency of Automated Valves

| Valve Type | Flow Rate (GPM) | Pressure Drop (psi) | Energy Efficiency (%) | Response Time (ms) | Durability (Cycles) |

|---|---|---|---|---|---|

| Electric Actuated Valve | 100 | 5 | 90 | 200 | 500,000 |

| Pneumatic Actuated Valve | 150 | 7 | 85 | 150 | 300,000 |

| Hydraulic Actuated Valve | 120 | 6 | 87 | 180 | 400,000 |

| Manual Valve | 90 | 10 | 75 | N/A | 1,000,000 |

Cost-Benefit Analysis: Investment vs. Performance in Automated Valve Solutions

When considering the implementation of automated valve solutions in industrial applications, a thorough cost-benefit analysis is critical. The initial investment in automated valves can be significant; however, it's essential to assess their long-term performance and efficiency gains. Automated valves often lead to reduced labor costs and increased operational reliability, as they can operate under conditions that might be hazardous for manual intervention. Moreover, the precision and speed at which these valves can regulate flow significantly minimize waste and enhance productivity.

When considering the implementation of automated valve solutions in industrial applications, a thorough cost-benefit analysis is critical. The initial investment in automated valves can be significant; however, it's essential to assess their long-term performance and efficiency gains. Automated valves often lead to reduced labor costs and increased operational reliability, as they can operate under conditions that might be hazardous for manual intervention. Moreover, the precision and speed at which these valves can regulate flow significantly minimize waste and enhance productivity.

On the flip side, one must also evaluate the potential pitfalls associated with these systems. Maintenance costs can be higher compared to traditional valves, as automated systems may require specialized training or parts, increasing the total cost of ownership. Additionally, the performance metrics must be scrutinized—how do these automated valves stand up to variations in the working environment, and do they consistently perform at optimal efficiency? By weighing these factors, businesses can make informed decisions that align their investments with performance expectations, ultimately leading to enhanced operational outcomes in the long run.

Real-World Case Studies: Success Stories of Automated Valves in Action

In the ever-evolving landscape of industrial automation, automated valves have emerged as critical components that enhance operational efficiency and precision. Numerous real-world case studies illustrate how businesses have successfully integrated these technologies into their systems. For instance, a major petrochemical plant in Louisiana reported a significant reduction in downtime after replacing traditional valves with automated counterparts. This transition enabled faster response times and minimized the risk of human error, ultimately boosting production rates and safety compliance.

Another noteworthy example comes from the food and beverage industry, where an automated brewing facility adopted advanced valve systems to streamline its processes. The introduction of smart valves allowed for precise control of fluid dynamics, which not only improved product consistency but also facilitated easier maintenance protocols. This case highlights how the implementation of automated solutions can lead to tangible benefits, such as enhanced productivity and reduced labor costs, paving the way for broader adoption across various sectors. These success stories emphasize the indispensable role of automated valves in modern industrial applications, showcasing their potential to transform operations in meaningful ways.

Performance Metrics of Automated Valves in Industrial Applications

Future Trends: Innovations Shaping the Future of Automated Valve Technology

The future of automated valve technology is primed for a significant transformation, driven by innovative trends that promise to reshape industrial applications. As industries strive for increased efficiency and precision, the development of smart automated valves is becoming more pronounced. These valves increasingly integrate advanced sensors and AI-driven analytics, enabling real-time monitoring and predictive maintenance, which significantly minimize downtime and enhance operational efficiency.

Moreover, the automotive industry is witnessing a notable surge in demand for automated valve solutions. Forecasts indicate that the global automotive valve market will reach an estimated value of $1,117.2 million by 2025 and is set to grow at a compound annual growth rate of 1.8% until 2033. This growing market reflects the combined effects of technological advancement and heightened focus on automation in manufacturing processes, emphasizing the vital role that automated valves will play in achieving greater production capacities and sustainability goals. As companies continue to invest in cutting-edge technologies, the landscape of automated valve solutions will inevitably evolve, aligning with the broader trends in industrial automation.

Related Posts

-

Premium Quality Air Control Valves: Leading Global Exports from China

-

Unlocking the Advantages of Superior Air Control Valves for Enhanced Performance

-

Understanding the Different Types of Control Valves: A Comprehensive Guide

-

Crafted in China's Leading Factory: The Trusted Excellence of Best Hydraulic Control Worldwide

-

Comprehensive Solutions for Optimizing Hydraulic Pressure Control Valve Performance

-

Understanding the Technical Specifications of the Best Hydraulic Valve and How to Choose the Right One for Your Needs